What is an M&A deal?

Mergers and acquisitions (M&A) are complex business transactions that often involve sharing sensitive information between companies. As a result, it’s important to ensure that the documents exchanged during these deals are protected from unauthorized access and remain confidential.

Tips on how to secure M&A documents and protect them during the transaction process

– Use encrypted communication: Email is a common means of exchanging documents during M&A deals, but it is not always secure. To protect sensitive information, consider using encrypted email services or virtual data rooms (VDRs) that allow for secure document sharing.

– Implement access controls: Ensure that only authorized individuals have access to sensitive M&A documents by implementing strict access controls. This can include password-protected access, two-factor authentication, and the use of digital signatures.

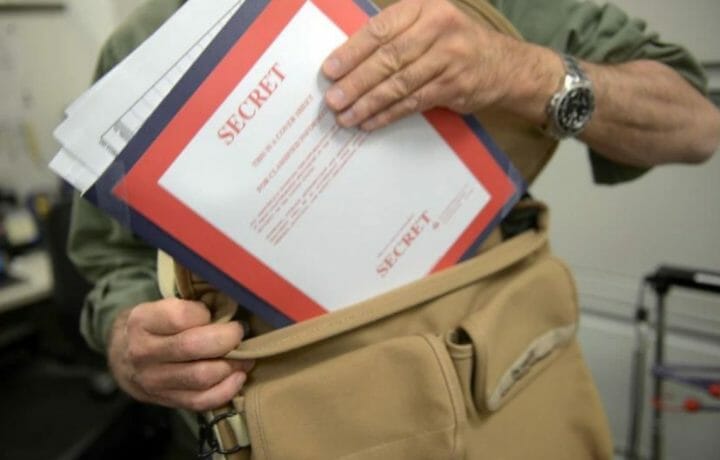

– Store data securely: When storing M&A documents, it’s important to use secure storage solutions such as cloud-based platforms or encrypted hard drives. This helps prevent unauthorized access or theft of sensitive information.

– Conduct background checks: When working with external parties such as financial advisors or legal counsel, it’s important to ensure that they have the necessary security measures in place to protect sensitive M&A documents. Conduct background checks on these parties to confirm that they have a good track record of maintaining confidentiality.

– Use non-disclosure agreements (NDAs): NDAs can help prevent the unauthorized sharing of sensitive M&A documents by requiring parties to keep the information confidential. Be sure to clearly define the terms of the NDA and have all parties sign it before exchanging any confidential information.

– Stay vigilant: The risk of unauthorized access to M&A documents is always present, so it’s important to remain vigilant and be aware of the latest security threats. Stay up to date on the latest security trends and implement best practices to help keep sensitive information protected.

How can VDRs help in M&A?

A virtual data room (VDR) is a secure, online platform that enables companies to securely exchange sensitive information during M&A transactions. VDRs are commonly used during the due diligence phase of M&A deals, as they provide a secure and centralized location for storing and sharing confidential information.

Here are a few ways that VDRs can help in M&A deals:

– Secure document sharing: VDRs provide a secure platform for sharing confidential information during M&A transactions. With features such as encrypted communications and password-protected access, VDRs help ensure that sensitive information is protected from unauthorized access.

– Streamlined due diligence: VDRs can streamline the due diligence process by providing a centralized location for storing and accessing all relevant information, including contracts, financial statements, and legal filings. This makes it easier for companies to conduct thorough due diligence and make informed decisions.

– Improved collaboration: VDRs facilitate collaboration between parties involved in the M&A deal, including legal teams, financial advisors, and executives. With a VDR, all parties can access the information they need in real time, reducing the risk of miscommunication and improving the efficiency of the deal.

– Enhanced control and monitoring: VDRs provide real-time reporting and auditing capabilities, allowing companies to monitor access to sensitive information and track changes to documents. This helps ensure that the information is being used appropriately and that all parties are complying with the terms of the transaction.

In conclusion, VDRs are a valuable tool for M&A transactions, providing a secure and centralized location for storing and sharing confidential information. By leveraging VDRs, companies can streamline the due diligence process, improve collaboration, and enhance control and monitoring, making it easier to make informed decisions and complete successful M&A deals.

How to choose a good VDR?

Here are some key factors to consider when choosing a VDR provider for M&A transactions:

– Security: Look for a VDR with strong security measures such as SSL encryption, multi-factor authentication, and 24/7 monitoring.

– User-Friendliness: Choose a VDR that is easy to use and navigate for all parties involved in the M&A transaction.

– Customization: Look for a VDR that can be tailored to meet the specific needs and requirements of the M&A transaction.

– Integration: Consider a VDR that integrates with other tools and systems used in the M&A process, such as project management or due diligence software.

– Technical Support: Make sure the VDR provider offers reliable and responsive technical support in case of any issues or questions.

– Pricing: Compare the pricing and features of different VDR providers to ensure that the company is getting the best value for its investment.

– Reputation: Research the reputation and track record of the VDR provider to ensure that it is reliable and has a history of successful M&A transactions.

– Compliance: Ensure that the VDR provider complies with relevant regulations and industry standards for M&A transactions, such as the European Union’s General Data Protection Regulation (GDPR).

– User Feedback: Read user reviews and case studies to get a better understanding of how the VDR has been used in real-life M&A transactions.

It is recommended to ask for demos and test drives of the VDR before making a decision in order to evaluate its security measures, user-friendliness, and other important factors. A well-chosen VDR can streamline the M&A process, protect sensitive information, and help ensure a successful transaction.

LeaksID Virtual Data Room

LeaksID can be used as a VDR for M&A transactions by providing a secure platform for storing, organizing, and sharing confidential information. The following are the ways in which LeaksID can be used as a VDR:

– Document Management: LeaksID provides a centralized repository (workspaces) for all the relevant documents related to the M&A transaction. This makes it easy to organize and access all the important information in one place.

– Secure Sharing: LeaksID allows authorized parties to access and review the information from anywhere, anytime. The platform provides advanced security features such as two-factor authentication, invisible labeling of all uploaded documents, and watermarking to ensure the confidentiality of the information.

– Reporting: LeaksID provides detailed reporting capabilities, including document access, activity, and user tracking to help monitor the progress of the M&A process and identify any potential security risks.

LeaksID streamlines the M&A process and safeguards sensitive information as a VDR. Its invisible marking feature ensures the security and integrity of the data, and makes it simple to identify the source of a potential leak, providing companies with an extra layer of protection.